I’m writing this post as the topic comes up a few times a week in the New Zealand Backpackers Facebook Group, so no doubt lots of you are looking for this information in other ways (e.g. via Google).

I’ll give you the TL;DR answer to start. Do read on (or do your own research) so you can be sure you know I’m not bullshitting and this is the cheapest way to send money to New Zealand.

p.s. I’m not a financial expert. This is just me trying to go through the process step by step in mid-March 2020. Make sure to do your own research and triple check any amounts you’re transferring 🙂

THE TL’DR ANSWER

In short, the cheapest way to send money to New Zealand is:

and/or

CurrencyFair.com

Yes, it depends.

Note: I’m only considering transferring money from one bank account to an NZ bank account. They both offer other services too, but that’s a whole new rabbit hole.

I played around with converting various amounts from various currencies into New Zealand Dollars. Sometimes TransferWise.com would get you more NZD, and sometimes CurrencyFair would. The differences were usually minimal so unless you must maximise every single dollar of value, I suggest you choose the one that suits your eye.

I’ll get into this more in the post.

TABLE OF CONTENTS

The codes/bonuses | Are these companies legit? | Side-by-side comparison | Alternatives

GET YOUR TRANSFERWISE CODE & CURRENCYFAIR CODE

I’ll pop this up to the top as some of you will only be here looking for the deals.

TransferWise:

Sign up link (no actual code): click here

What do you get by signing up with this link? You get one free international transfer of up to £500. Hooray.

What do I get? I’ll receive £50 when three people transfer over £200 using the link. Hooray.

CurrencyFair:

Sign up link (no actual code): click here

What do you get by signing up with this link? You get €30 added to your account when you do a minimum transfer of 2000 EUR or equivalent.

What do I get? I get €30 too. Hooray.

IS TRANSFERWISE LEGIT? AND CURRENCYWISE?

I get it, there are lots of dodgy methods of people and businesses attempting to scam you when money is involved, especially over the internet. So I’ll provide some information about them. You can read about where they’re both regulated further below.

TransferWise.com:

But TransferWise is legit, I’ve used them myself and recommend them 100%.

The two co-Founders started the company after coming across a problem many of us have, the fees transferring money the traditional way via banks was too hectic. They used to transfer money to each other (they lived in different countries) bank accounts to avoid the fees, but then figured out that other people are in the same situation as them.

And so in 2010 TransferWise was born, and since then they’ve helped millions of people. As of the last update on their about page they help four million people transfer four billion every month. Using those two numbers alone would mean the average transfer amount is $1000.

They employ 1300 people, received investment money from well known VC’s like Peter Thiel and Richard Branson and continue to innovate with new product offerings and speed of service.

CurrencyFair.com:

I have not used CurrencyFair as of yet, but after reading the about page, reviews, and talking to people who have I do trust them and would recommend them.

Their story is similar to TransferWise in that they wanted to solve the problem of sending money between friends, but make it happen on a larger scale. They were founded in 2009, and while they don’t mention the founders (Brett Meyers, David Christian, Jonathan Potter, Sean Barrett according to CrunchBase.com) on the about page they have screenshots of the upper management (accountability), and the organisations that have invested in them so they aren’t hiding.

SIDE-BY-SIDE COMPARISON

This section will make a direct comparison between TransferWise and CurrencyFair fees, speed of transfer, and trust levels.

TransferWise vs CurrencyFair fees

Don’t forget, you can sign up using these links (

CurrencyFair) and (TransferWise) to get the bonuses mentioned earlier.

The fee structures are different depending on where you transfer the money from. Here are a few examples of what you’ll receive at the time of publishing, though it’s easy to do yourself in real-time (you could check against NZ supermarket prices here).

TransferWise

Exchange rate: 1.68067

Fees: USD1.75 ACH fee + USD6.09 USD fee

Amount Received: NZD$831.16

CurrencyFair

Exchange rate: 1USD = 1.6719NZD

Fees: $5 fixed fee.

Amount Received: NZD$830.85

TransferWise:

Exchange rate: 1 GBP = 2.03739 NZD

Fee: 6.56 GBP Low cost transfer fee

Total Received: $3,103.84 NZD

CurrencyFair:

Exchange rate: 1 GBP = 2.0234 NZD

Fee: $5 NZD

Total Received: $3,090.80 NZD

TransferWise:

Exchange rate: 1 EUR = 1.85565 NZD

Fee: 9.48 EUR Low cost transfer fee

Total Received: $3,694.33 NZD

CurrencyFair:

Exchange rate: 1 EUR = 1.8451 NZD

Fee: $5 NZD

Total Received: $3,685.20 NZD

TransferWise

Exchange rate: 1.68067

Fees: 44.71 AED

Amount Received: NZD$2,283.06

CurrencyFair

Exchange rate: 1 AED = 0.45830 NZD

Fees: $5 fixed fee.

Amount Received: NZD$2,286.59

Are TransferWise and CurrencyFair trustworthy?

I’ve already talked about the trust a little bit, but I wanted to touch on it again.

There are lots of corrupt people out there, but fortunately, they’re a tiny minority and you and I are going to be trustworthy and stick to our word.

In terms or TransferWise and CurrencyFair, they’re both very trustworthy to me. If you look on Trustpilot.com which is a review platform that everyone can use, both options do well. You can see this in the screen shot below, or follow the links here for TransferWise and here for CurrencyWise.

The ratings of their competitors?

- WesternUnion: Great

- PayPal: Bad

- Xoom: Excellent

These are three alternatives I mention below among others.

How else can you trust them?

By where they are regulated security-wise. I won’t get into the weeds of this as it’s all beyond my head, but:

CurrencyFair is regulated with offices Ireland, Australia, United Kingdom, Singapore, and Hong Kong (more info).

TransferWise is regulated in Hong Kong, USA, New Zealand and more (more info).

ALTERNATIVE OPTIONS

Of course, the currency you’re transferring from might not be available in which case you’ll have to look at other avenues.

What I found interesting is that both TransferWise and CurrencyFair didn’t use one another as an example of what you can get from competitors on their website.

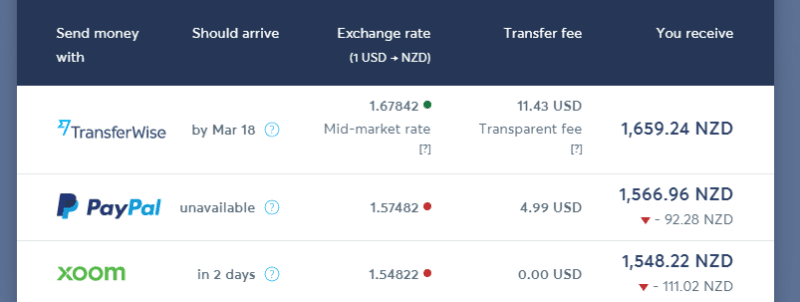

TransferWise compares its rates to PayPal and Xoom. Compared to these them, TransferWise is a clearer winner.

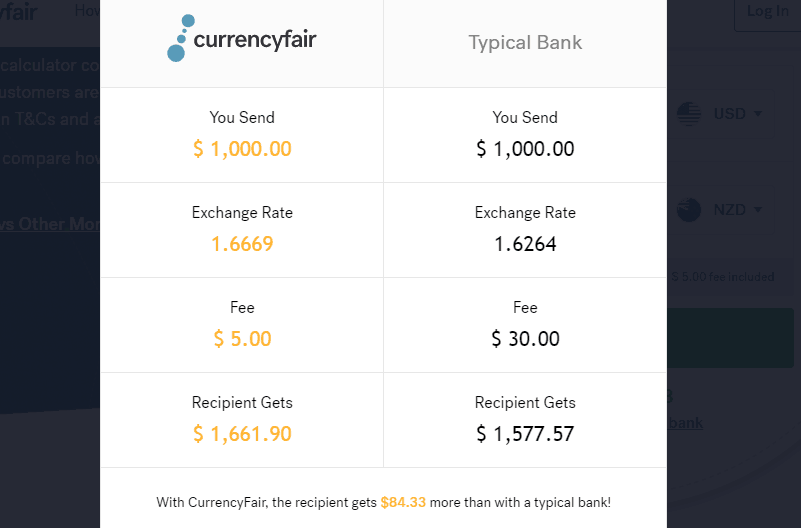

CurrencyFair compares their rates to a regular bank that they assume charges a $30 commission and uses a weak exchange rate. This is accurate and a good example to include as you might have considered using your bank, but again, I’d love to compare themselves to other competitors.

But from what I have researched, these are the two leaders in the industry in terms of offering the cheapest way to send money to New Zealand. If you want to look at other options or yourself check out Payoneer, WesternUnion, OFX, and Transfast. There are more!

Well, that was a mission to go through. I hope I’ve shown you why I think either CurrencyFair or TransferWise is the best way to send money to New Zealand.

There’s a good chance the details have changed in the post since I’ve published it. If they have, let me know and I’ll make sure things are updated.

Hey, it’s Jub here. I’m the guy behind Chur New Zealand, helping you have the best time hiking, trekking, walking…whatever you want to call it…in NZ. I’m based in Queenstown and am always out and about exploring trails, old & new. If you have any questions, reach out.